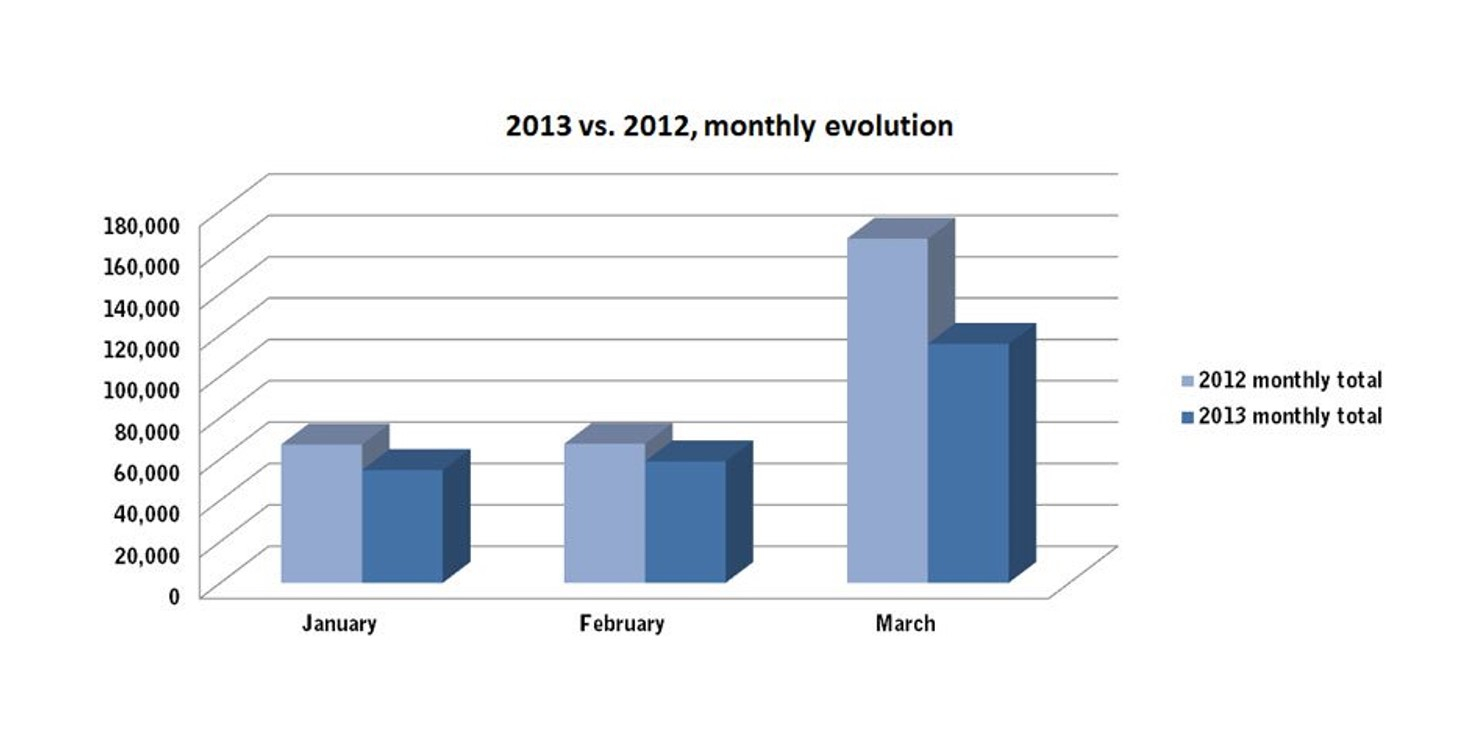

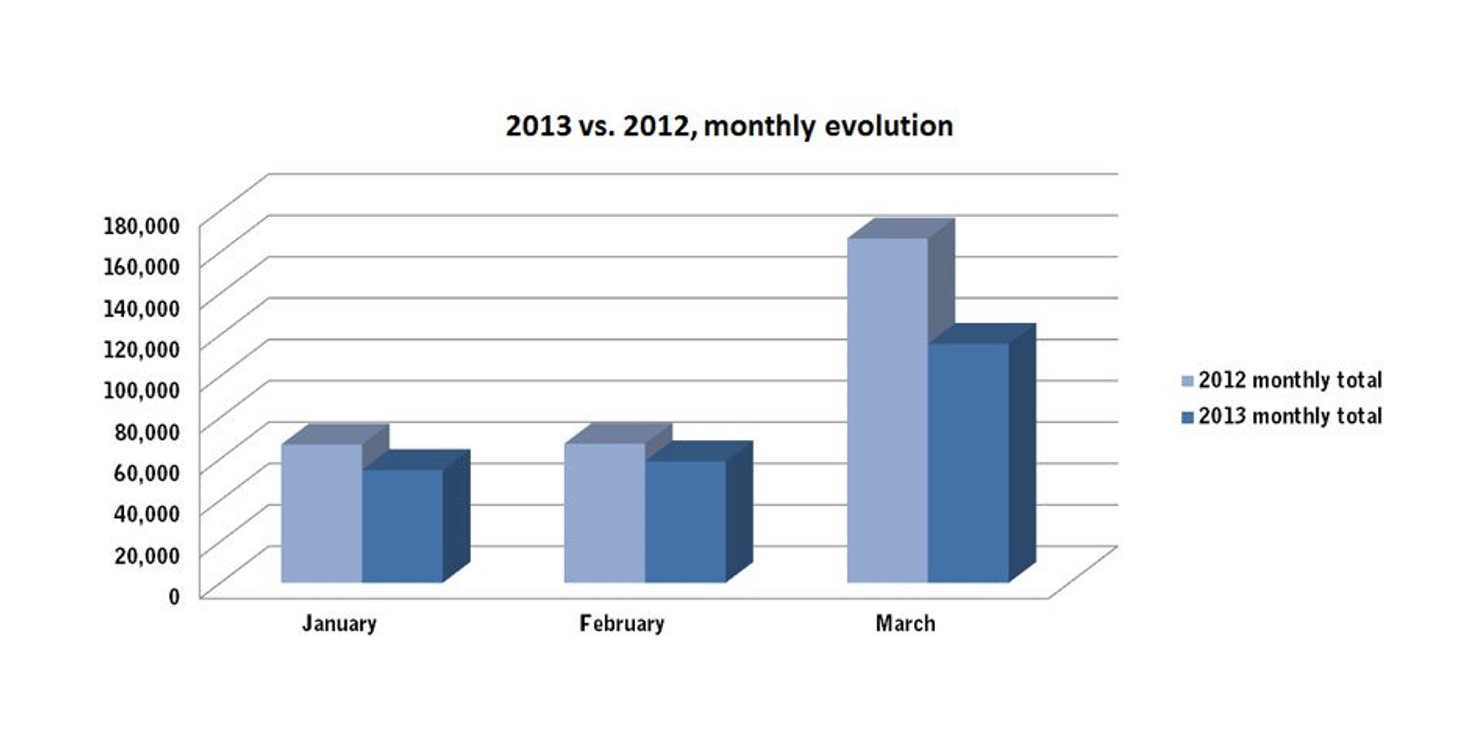

The first quarter of 2013 ended down by 23.8%, with Southern Europe continuing to be a motive of serious concern. In March the European PTW market posted the year-on-year decline of 30.6% over the same period in 2012.

The first quarter of 2013 ended down by 23.8%, with Southern Europe continuing to be a motive of serious concern. In March the European PTW market posted the year-on-year decline of 30.6% over the same period in 2012. While the EU PTW market had lost 12.7% in 2012, for the first quarter of 2013 registration figures indicate the enduring effects of the current economic crisis on consumer’s demand.

March Powered Two-Wheeles sales in Europe totalled 115.470 units, with first quarter sales at 228.845. In Q1 2013 motorcycle registrations fell 22.7%, while moped sales were down 26.5%.

The cause of the acceleration of this negative trend can be explained by the negative performance of Europe’s second largest market, namely Italy with -37% for all categories (2-, 3- and 4-wheeled L-category vehicles). Spain also lost 22.4%, while Greece -31.3%.

Following last year’s strong volume reduction in the Mediterranean countries, during the first quarter of 2013 Continental Europe seems to be following in the same wake: Germany was down 16%, France -21%, Poland -32.8%, The Netherlands -24.4%, Austria -25%.

The seasonal effect can partly explain this disappointing performance. The extreme rigour of last winter all over Europe is a text book example of how far weather conditions can influence the PTW market.

However, a worsening of the situation such as this reflects deeper economic and political uncertainty in affected European countries which translate into a loss of cusomers’ purchasing inclination bringing the market to a halt. Eventually, the onset of spring will certainly have a positive impact on sales, possibly trimming the accumulated losses.

Statistical overview 2012.

ACEM published the statistical overview for the full year 2012. The document contains the yearly summary for registrations and deliveries, circulating park, production, and top 10 models. The file can be downloaded here.